Capital Gains Tax Rate 2024 Real Estate Ca

Capital Gains Tax Rate 2024 Real Estate Ca. The first $250,000 of capital gains remains subject to the 50% inclusion rate, resulting in $125,000 included in taxable income. In addition, single filers making $125,000 or more annually will pay a net investment income tax of 3.8% on capital gains from real estate.

June 25, 2024, to be exact. So for the first $250,000 in.

California Has No Specific Capital Gains Tax Rates But Imposes The Regular California Income Tax Rate On Any Capital Gain.

If a real estate investor sells a rental property for a profit, they may be subject to capital gains tax on the profit generated from the sale.

In Simple Terms, This Capital Gains Tax Exclusion Enables Homeowners Who Meet Specific Requirements To Exclude Up To $250,000 (Or Up To $500,000 For Married.

For a decade, the top california income tax rate was 13.3%, but effective on jan.

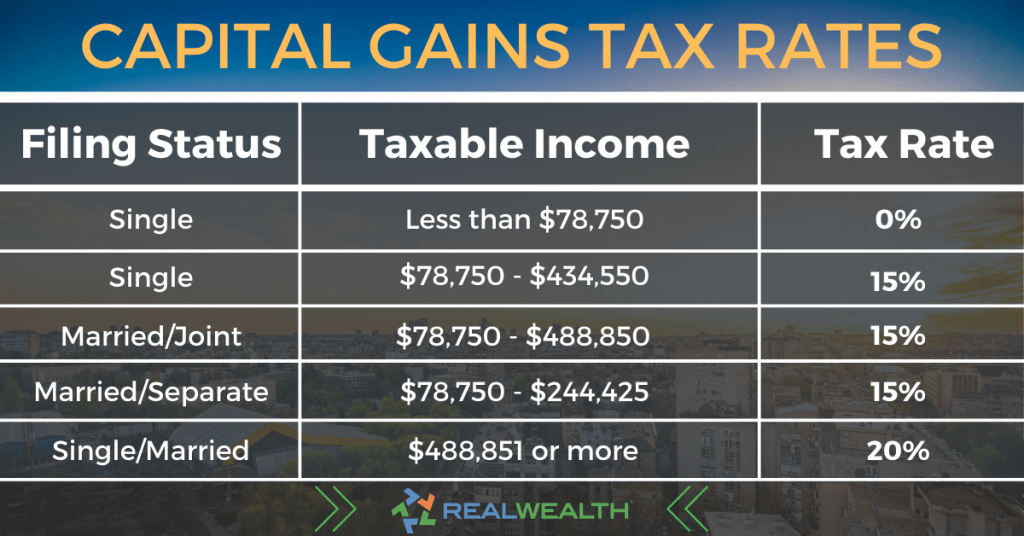

The Tax Rate Is Determined By An Individual’s Taxable Income And Filing Status.

Images References :

Source: myrlenewelena.pages.dev

Source: myrlenewelena.pages.dev

California Capital Gains Tax Rate 2024 Real Estate Carley Margaux, Capital gains realized by individual taxpayers on or after june 25, 2024 will only be subject to the increased inclusion rate on the portion of those gains that exceed. For instance, single filers with taxable income exceeding $1.

Source: erikabdarlene.pages.dev

Source: erikabdarlene.pages.dev

California Capital Gain Tax Rate 2024 Alyson Andreana, For individuals the increase will apply only. So for the first $250,000 in.

Source: myrlenewelena.pages.dev

Source: myrlenewelena.pages.dev

California Capital Gains Tax Rate 2024 Real Estate Carley Margaux, For instance, single filers with taxable income exceeding $1. The remaining $100,000 of gains is.

Source: fainablorianna.pages.dev

Source: fainablorianna.pages.dev

Real Estate Capital Gain Tax Rate 2024 Ange Maggie, The first $250,000 of capital gains remains subject to the 50% inclusion rate, resulting in $125,000 included in taxable income. June 25, 2024, to be exact.

Source: trudiqcathrine.pages.dev

Source: trudiqcathrine.pages.dev

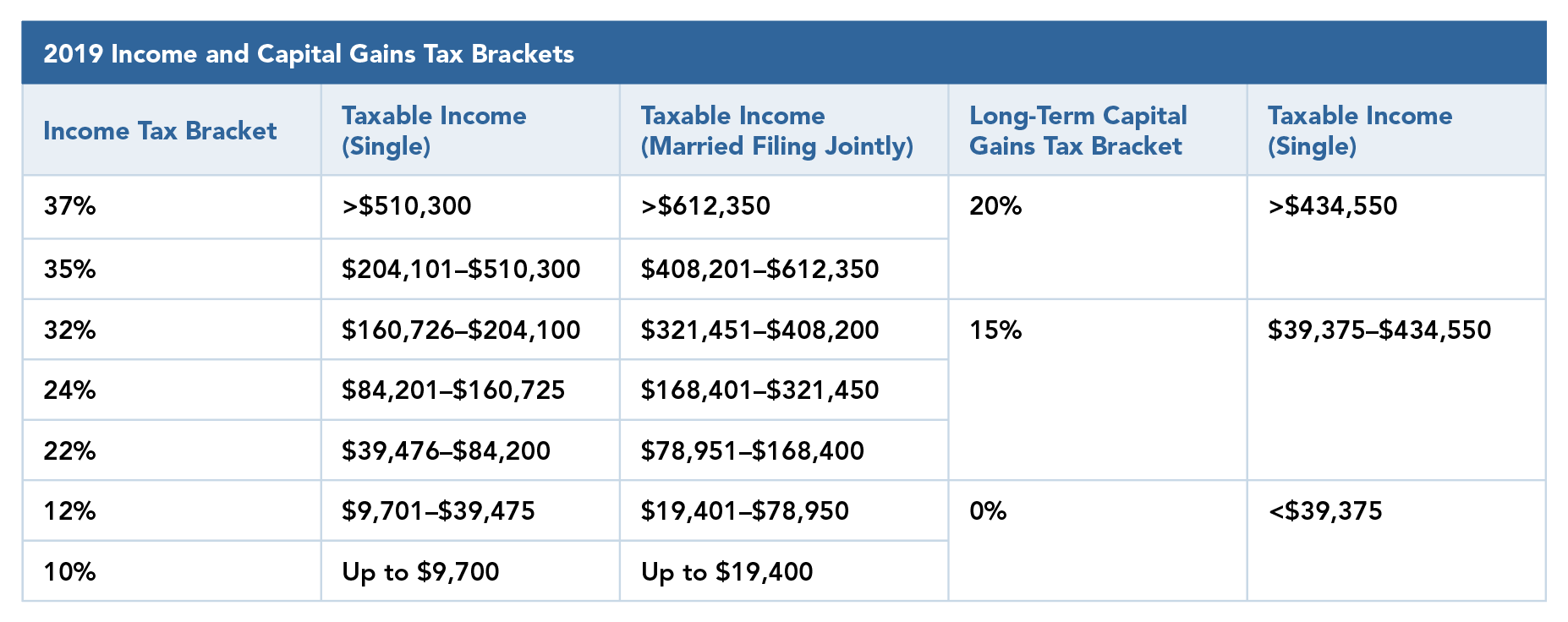

2024 Capital Gains Tax Rates Alice Brandice, For individuals the increase will apply only. We've got all the 2023 and 2024.

Source: juno.finance

Source: juno.finance

Juno A Guide to Real Estate Capital Gains Tax, California has nine tax brackets: The remaining $100,000 of gains is.

Source: clioamaisie.pages.dev

Source: clioamaisie.pages.dev

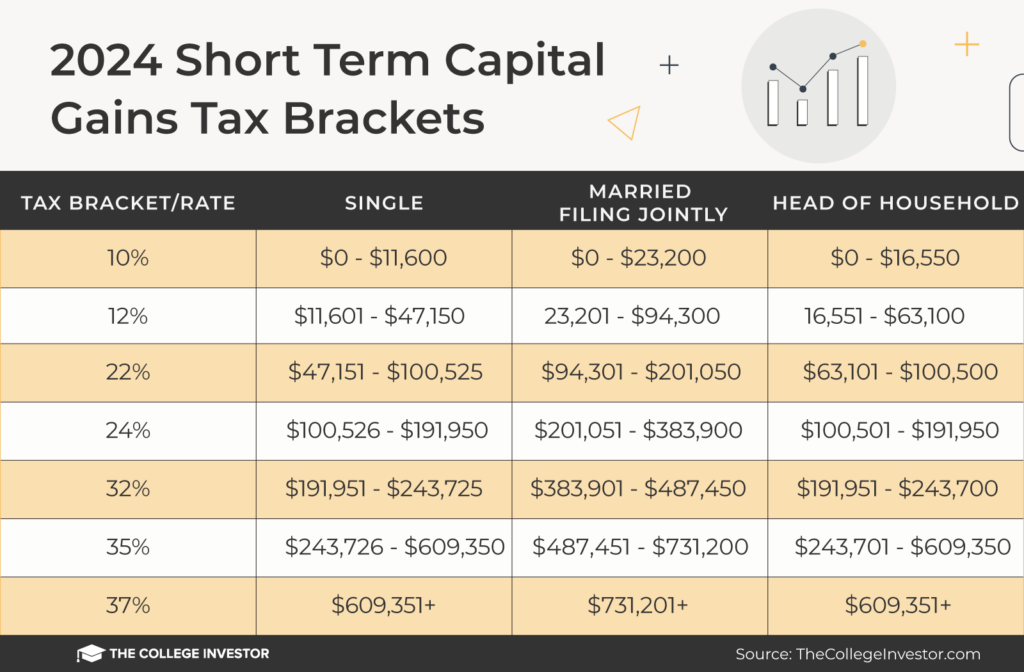

Tax Bracket Capital Gains 2024 Ettie, Generally, capital gains and losses occur when you sell something for more or less than you spent to purchase it. According to the corelogic report, in the fourth quarter of last year, 28.8% of all home sales in california were potentially subject to capital gains taxes.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

Capital Gains Tax Brackets And Tax Rates, Generally, capital gains and losses occur when you sell something for more or less than you spent to purchase it. These numbers change slightly for 2024.

Source: taxrise.com

Source: taxrise.com

Capital Gains Tax A Complete Guide On Saving Money For 2023 •, For individuals with a capital gain of more than $250,000, they will be taxed on 66.67% of the gain as income—up from the current 50% rate, according to budget 2024. According to the corelogic report, in the fourth quarter of last year, 28.8% of all home sales in california were potentially subject to capital gains taxes.

Source: your-projector-site.blogspot.com

Source: your-projector-site.blogspot.com

new capital gains tax plan Lupe Mcintire, California has nine tax brackets: Here’s how this change could impact your real estate transactions:.

The Rates Are 0%, 15% Or 20%, Depending On Your Taxable.

When you sell an asset like a rental property or some investment products like stocks and you make a profit, capital gains.

With Notes From Penelope Graham.

For the 2024 tax year, you won’t pay any capital gains tax if your total taxable income is $47,025 or less.